Why You Should Always Do Your Own Due Diligence When Buying Property

- Tome Avelovski

- Aug 19, 2025

- 2 min read

Looking Beyond the Selling Agent’s Pitch

When it comes to buying property, the stakes are high—and so are the risks if you take everything at face value. While selling agents play a valuable role in the process, it’s crucial to remember that their primary motivation is to achieve a sale for the vendor. This means you can’t always rely on their assurances, even when they sound reassuringly detailed.

A recent experience drove this lesson home for us. We were presented with an off-market property, enthusiastically described as “flood free.” On the surface, it sounded ideal. But we know that property due diligence is about more than accepting a label or a quick tick on a checklist. It’s about digging deeper—sometimes literally.

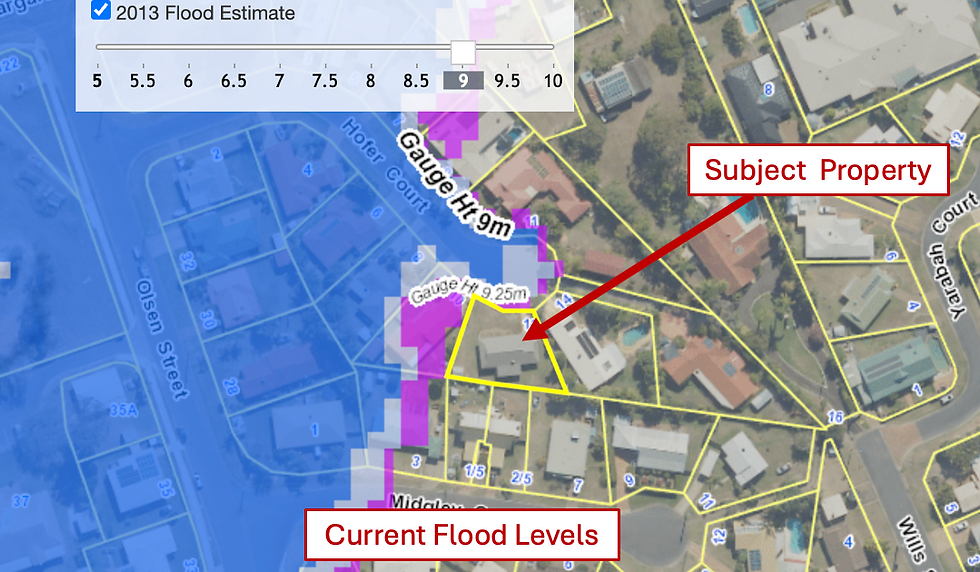

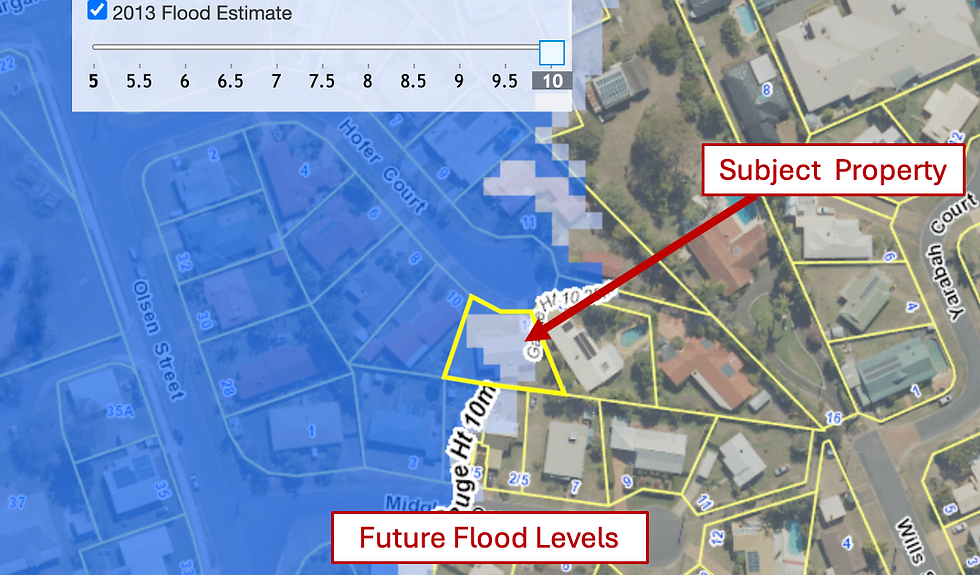

Our own investigation revealed that, while the property itself was technically not within the official flood zone, the zone boundary reached the neighbouring property. Not only that, but historical records showed that floodwaters had in fact reached that neighbouring property during the 2013 floods.

Looking at future flood mapping and climate predictions, it became clear that the property we were offered could very well be at risk of flooding in the years ahead.

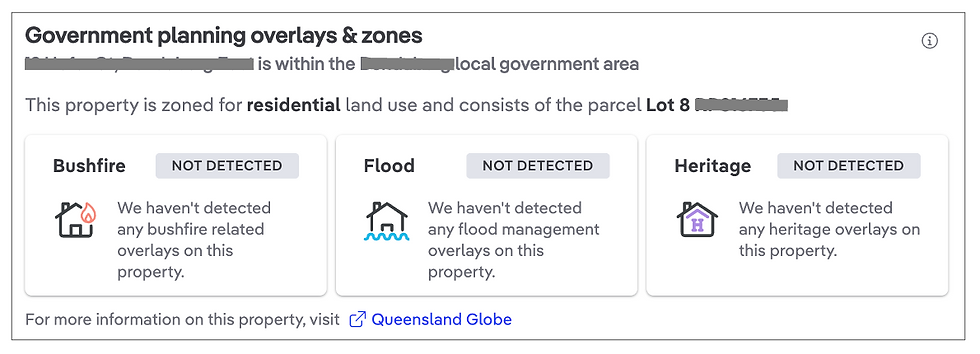

Even popular online property platforms, which many buyers consult for information, flagged the site as being outside of a flood zone which again, it 'technically' is. Still, these platforms only tell part of the story.

The extract below shows the planning overlays from one of the popular free website resources (which many buyers rely on, unfortunately) indicating the property is not within the flood zone.

Flood risk, for example, isn’t just about what has happened in the past or where the current boundary lines fall—it’s also about what could happen in the future. Local council documents, state flood studies, climate trend projections, and even anecdotal evidence from neighbours can provide layers of insight that standard reports and agent briefs may miss.

The lesson here is simple: never assume that “flood free” or any other reassurance from a selling agent tells the whole story. Take the time to obtain your own reports, consult local authorities, look at historical data, and ask the hard questions. And don’t stop at the first online search result—keep digging until you’re confident you understand the risks.

Property is one of the biggest investments most people will ever make. Doing your own due diligence isn’t just a box-ticking exercise—it’s essential protection of your future investment and peace of mind.

If you're looking for a Buyer’s Agent or Qualified Property Investment Adviser (QPIA®) to assist you with purchasing a home or investment property in NSW, QLD, VIC, SA or WA, please get in touch with our team at Ready Set Buy - Property Buyer's Agents or give us a call on 1300 289 372!

Disclosure: The information contained in this blog is our personal opinion only and is not to be taken as financial advice or any other advice, as we do not know your financial situation. Property markets are volatile and all investments carry risks. Please speak with your accountant or any other licensed professional for specific advice based on your own personal circumstances. We will not be held liable for any losses.

Comments